Plan

On May 31, 2012, the Securities and Exchange Commission (SEC) approved, on a pilot basis, a National Market System Plan, known as the Limit Up/Limit Down ("LULD") Plan, to address extraordinary market volatility. The Plan was approved as a permanent rule on April 11, 2019.

The LULD Plan is administered by the LULD Operating Committee, comprising a representative from each of the Participants. The current Participants are the Cboe BZX Exchange, Inc., Cboe BYX Exchange, Inc., Cboe EDGX Exchange, Inc., Cboe EDGA Exchange, Inc., Financial Industry Regulatory Authority, Inc., Investors Exchange LLC, Long-Term Stock Exchange, NASDAQ BX, Inc., NASDAQ PHLX LLC, The Nasdaq Stock Market LLC, New York Stock Exchange LLC, NYSE American LLC, NYSE Arca, Inc., NYSE Chicago, Inc., and NYSE National, Inc. The Plan and any amendments to it are filed with and approved by the Securities and Exchange Commission in accordance with Section 11A of the Securities Exchange Act of 1934.

Overview

The Plan is designed to prevent trades in NMS Stocks from occurring outside specified price bands, which are set at a percentage level above and below the average reference price of a security over the preceding five-minute period. The percentage level is determined by a security's designation as a Tier 1 or Tier 2 security. Tier 1 comprises all securities in the S&P 500, the Russell 1000 and select Exchange Traded Products (ETPs). Tier 2 comprises all other NMS securities, except for rights and warrants, which are specifically excluded from coverage. The Plan applies during regular trading hours of 9:30 am ET - 4:00 pm ET.

Calculation of Price Bands

The price bands, consisting of a Lower and Upper Price Band for each NMS Stock, are calculated by the two SIPs - CTA and Nasdaq UTP. The SIPs calculate upper and lower price bands by applying a formula to a Reference Price, which is the arithmetic mean price of Eligible Reported Transactions over the prior five minute period. The first Reference Price of the day is either the primary market's opening price or the primary market's previous day's closing price/last sale when opening on a quote. If no eligible trades have occurred in the prior five minutes, the previous Reference Price remains in effect. The Reference Price is updated after 30 seconds only if a new Reference price would be least 1% away from the current Reference Price.

The Price Bands are calculated by multiplying the current Reference Price by the applicable Percentage Parameter and then adding or subtracting that value from the Reference Price and rounded to the nearest penny.

Price Band = (Reference Price)+/- ((Reference Price)x (Percentage Parameter))

| Tier 1 Securities and Tier 2 Symbols below $3.00 (9:30am - 3:35pm) | |

|---|---|

| PREVIOUS CLOSING PRICE | PERCENTAGE PARAMETER |

| Greater than $3.00 | 5% |

| $0.75 up to including $3.00 | 20% |

| Less than $0.75 | Lesser of $0.15 or 75% |

| Tier 2 Securities (9:30am - 4:00pm) | |

|---|---|

| PREVIOUS CLOSING PRICE | PERCENTAGE PARAMETER |

| Greater than $3.00 | 10% |

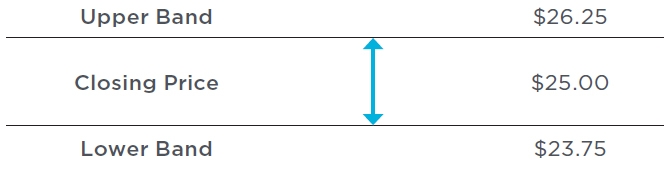

Illustration: Assume that "XYZ" is a Tier 1 security and has a previous closing price of $25. As such, its percentage parameter would fall within the first bucket (Greater than $3.00) of Table 1 above. Security XYZ would therefore have upper and lower price bands that are 5% greater ($26.25) and lower ($23.75) than that of the previous closing price, respectively. The bands would be as follow:

Operation of Price Bands

When the National Best Bid (Offer) is below (above) the Lower (Upper) Price Band, the SIPs disseminate the National Best Bid (Offer) with an indicator identifying it as unexecutable. Trading immediately enters a Limit State if the National Best Offer (Bid) equals but does not cross the Lower (Upper) Price Band. When a Limit State occurs, the SIPs indicate the National Best Bid (Offer) as a Limit State Quotation. Trading exits a Limit State if, within 15 seconds of entering the Limit State, all Limit State Quotations are executed or canceled in their entirety. If the market does not exit a Limit State within 15 seconds, the primary listing exchange declares a five-minute Trading Pause. The Trading Pause may be extended for another five minutes. Thereafter, all markets may resume trading. If a security is in a Trading Pause during the last 10 minutes of regular trading hours, the primary listing exchange will not reopen trading and will attempt to execute a closing transaction using its established closing procedures.

A Straddle State occurs when the National Best Bid (Offer) is below (above) the Lower (Upper) Price Band and the NMS Stock is not in a Limit State. For example, assume the Lower Price Band for an NMS Stock is $9.50 and the Upper Price Band is $10.50, such NMS stock would be in a Straddle State if the National Best Bid were below $9.50, and therefore non-executable, and the National Best Offer were above $9.50 (including a National Best Offer that could be above $10.50). If an NMS Stock is in a Straddle State and trading in that stock deviates from normal trading characteristics, the primary listing exchange may declare a Trading Pause for that NMS Stock.

Please consult each Participant market's trading rules to learn how its order types are treated under the Plan.